The Federal Poverty Level is holding us back

“The current public assistance program structure creates economic disincentives for individuals to strive toward career advancement and rise out of poverty”.

—Women’s Fund of the Greater Cincinnati Foundation

The Women’s Fund of the Greater Cincinnati Foundation, researches and analyzes gender based income inequities. They are the “region’s expert on the status of women’s economic self-sufficiency”. In July 2020 they released their updated report: The Cliff Effect and Other Disincentives in our Public Benefit System. The report presents the Cliff Effect problem but also makes recommendations for solutions.

The Federal Poverty Level and the Cliff Effect

The Federal Poverty Level is a calculated earned income level that is used to determine who is eligible for subsidies—such as Medicaid or Housing Assistance. This calculation was created in 1965 and though adjusted for inflation over the years, doesn’t reflect our current day expenses. The biggest problem with the FPL is that it doesn’t take into account standard of living by geographical locations. The same poverty level is used in Mississippi (one of the poorest states) as in New York City, which is certainly more expensive.

Once the threshold for benefits has been maxed out (by earning more), workers often cannot afford to purchase the services that were previously being provided. For instance, a worker who previously qualified for Medicaid might not be able to afford the insurance plans being offered through the ACA (Affordable Care Act or “Obamacare”). Another similar example is when a worker who received a raise no longer qualifies for a Child Care Subsidy but cannot afford to pay to send their child to day care.

The gap just after the maximum eligibility threshold is a phenomenon called the “Cliff Effect”. Many workers fear this income cliff which causes them to avoid pay increases or professional or personal advancements. If the FPL were abandoned or adjusted to reflect a more realistic Self-Sufficiency Standard, the Cliff Effect could be greatly diminished or even eradicated.

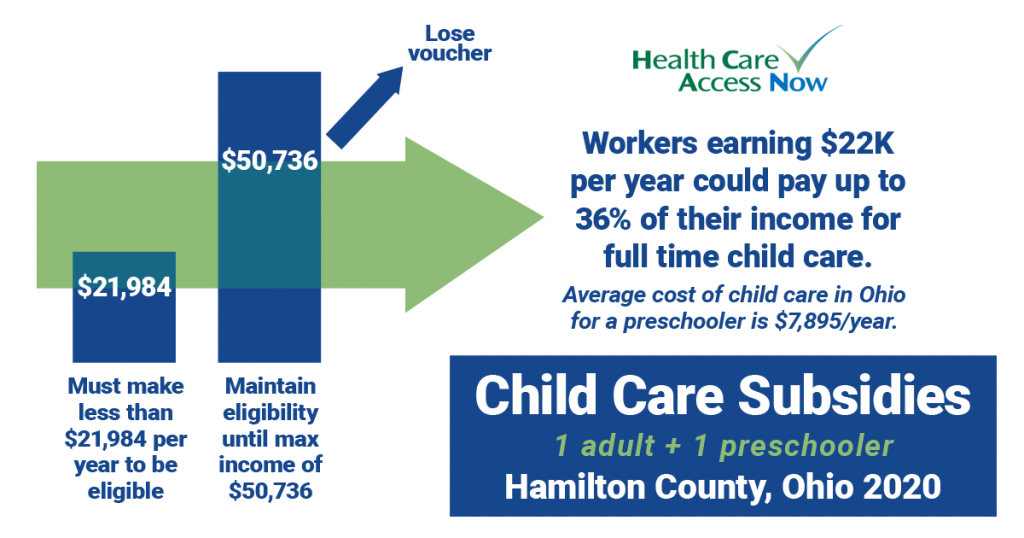

Ohio Child Care Voucher

In Ohio those receiving a Child Care Voucher certainly can experience the cliff effect, when they max out their income threshold. But an additional issue in our state is that many don’t qualify even though they certainly could benefit from the program. To be eligible a single parent with one child must earn no more than 130% of the FPL ($21,984 per year). They then receive some amount of assistance until they max out at 300% ($50,736 per year). But what about a worker who earns $22,000? They don’t qualify for the subsidy but still need to pay for child care. The $22,000 per year earner could be asked to pay a very large percentage of their wages toward child care.

From their report the the Women’s Fund says: “There is no quick fix to the benefit cliffs and other structural disincentives in our public benefits systems. However, by implementing a variety of measures and new approaches, government, business and non-profit leaders can smooth the cliffs, reduce the disincentives and create a system that provides a true pathway to self-sufficiency”.

Resources

- Cliff Effect report: See the Women’s Fund report for recommendation for policymakers, employers and the community.

- Employers: Check out The Women’s Fund Employer Toolkit for solutions to improve workplace policies to help support, stabilize and retain low-wage employees. (You must create an account on the toolkit website in order to access the kit).

- Are you paying or earning a self-sufficient wage? Check out the Self-Sufficiency Calculator.